The biogas digesters market is experiencing robust growth, with pundits forecasting it to exceed between $63 billion by 2037 at a >5.9% CAGR, and even as high as $128.6 billion by 2032, expanding at a CAGR of 4.2%.

Key drivers include the shift toward renewable energy, waste-to-energy initiatives, and rising fertilizer costs, boosting digestate demand. Europe remains the largest market, while small-scale digesters surge in Asia-Pacific and Africa.

Key Takeaways – Biogas Digesters Market Trends

- The biogas digesters market worldwide is predicted in one report to reach $128.6 billion by 2032, expanding at a CAGR of 4.2% from its 2023 value of $89 billion.

- Environmental regulations, waste management needs, and energy independence are the main factors driving the rapid adoption of biogas technologies.

- Residential biogas systems are projected to surpass the $11 billion threshold by 2032, with compact, user-friendly designs making renewable energy available to homeowners.

- Asia Pacific currently leads with a 30% market share, while technological advancements such as high-efficiency digesters and smart monitoring systems are transforming the sector.

- Despite high upfront installation costs (70-95% of total biogas expenses), biogas digesters provide a promising return on investment through multiple revenue streams and environmental benefits.

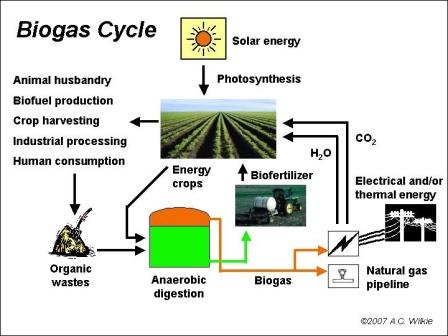

The renewable energy sector is undergoing a quiet revolution, one that turns what we once thought of as waste into valuable energy. Biogas digesters are central to this revolution, turning organic materials into clean, renewable energy through anaerobic digestion. As concerns about the climate increase and waste management becomes more challenging, these systems are quickly moving from the fringes of alternative energy to the mainstream.

Are you interested in contributing to a more sustainable future and possibly securing energy independence? Sistema.bio and other top biogas technology providers are making this more and more achievable through innovations that enable everyone from homesteaders to industrial facilities to generate their own renewable energy from organic waste.

Understanding Biogas Digesters

Biogas digesters utilize the power of natural biological activities to decompose organic substances without the presence of oxygen, generating biogas primarily made up of methane and carbon dioxide.

This biogas can be utilized for power production, heating, cooking, or even as automobile fuel after it has been upgraded. The leftover digestate acts as a fertilizer high in nutrients, forming a closed-loop system that meets both energy and farming requirements at the same time.

“Digesters – Experiential Learning Lab …” from soils.ifas.ufl.edu and used with no modifications.

Biogas Revolution: A $128.6 Billion Market by 2032

There's a compelling story of growth and opportunity in the Biogas Digesters Marketwhen you look at the numbers. The global biogas market was valued at around $89 billion in 2023. It is very optimistically projected to reach $128.6 billion by 2032, representing a steady compound annual growth rate (CAGR) of 4.2%.

This isn't just incremental growth—it's a fundamental shift in how we approach waste and energy. The biodigester segment, in particular, was valued at over $30.05 billion in 2024 and is forecasted to reach $63.31 billion by 2037, growing at an even more impressive 5.9% CAGR.

What's really remarkable is how this growth is happening at all levels. Whether it's residential systems that are predicted to exceed $11 billion by 2032 or industrial-scale operations, biogas technology is being implemented at all sizes to meet a variety of needs. As of 2022, the installed capacity of biogas energy around the world is already around 21.5 gigawatts, with plenty of potential for more.

What's Behind the 4.2% Yearly Increase in Biogas Digesters?

The increase in biogas use isn't a coincidence. Numerous factors are coming together to create the perfect environment for this renewable energy solution to flourish in the next decade.

Global Environmental Laws and Carbon Reduction Goals

Across the globe, governments are setting more rigorous carbon reduction goals, with many nations pledging to achieve net-zero emissions by the middle of the century. Biogas digesters provide an immediate solution for reducing methane emissions from the decomposition of organic waste, while also reducing the use of fossil fuels. These dual environmental advantages make biogas technologies a strong contender in regulatory structures intended to fulfil climate obligations. The capability to convert what would otherwise be harmful waste into clean energy is a persuasive argument for regulators seeking established climate solutions.

Addressing the Global Waste Crisis

With landfills around the world reaching their maximum capacity and organic waste producing harmful methane emissions, the global waste crisis is becoming more severe. Biogas digesters offer a direct solution to this issue, transforming organic waste into valuable resources and reducing the amount of waste sent to landfills. As the cost of waste disposal continues to rise, solutions that can effectively process waste rather than simply storing it are becoming more economically viable.

City waste management services are beginning to take note of the Biogas Digesters Market and to see the dual advantage of reducing the amount of waste they have to dispose of while also making money from the energy they produce. For businesses that produce organic waste, creating biogas on-site can turn an expense into a potential source of income, while also showing that they care about the environment.

- Lower costs for waste disposal and landfill tipping

- Potential income from energy and fertilizer production

- Decreased risks and liabilities related to environmental compliance

- Improved corporate social responsibility credentials

- Implementation of a circular economy with minimal waste output

Increasing Energy Costs and Energy Independence

Volatility in the global energy market has led many organizations and communities to seek more stable and predictable sources of energy. Biogas systems provide energy independence by using locally available feedstocks to generate reliable power.

This model of localized production is a feature of the Biogas Digesters Market that protects users from fluctuations in international energy prices and supply disruptions. In rural and agricultural settings, where biomass resources are plentiful but energy infrastructure may be lacking, biogas can provide vital energy security.

For more insights into biogas industry connections, visit the American Biogas Council.

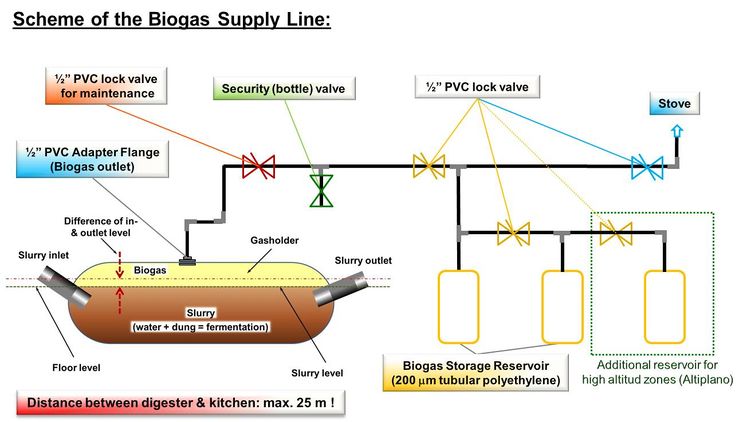

“Polyethylene Biogas Digester (PBD …” from energypedia.info and used with no modifications.

Government Support and Subsidies

Government support mechanisms that assist the Biogas Digesters Market have a significant impact on the biogas market, helping to offset the relatively high initial capital investment.

This support comes in many forms, from direct installation subsidies to feed-in tariffs for electricity generated from biogas. Tax credits, grants, and low-interest financing programs specifically for renewable biogas projects are increasingly common in both developed and developing economies.

The economic viability of many biogas projects relies on effectively using these support mechanisms, which can significantly improve return on investment timelines.

How Biogas Use is Changing Various Industries

Biogas's adaptability is probably its most attractive quality, making it possible for it to meet various energy requirements in a variety of sectors. This versatility is increasing adoption in industries as varied as agriculture, manufacturing, utilities, and transportation. As upgrading technologies get better, the uses for biogas keep growing, opening up new market possibilities and sources of income for producers.

Progressive organizations are deploying multi-purpose strategies to capture various value streams from a single biogas installation. By combining the generation of electricity with heat recovery and possibly biogas upgrading, operators can maximize the economic return on their investment. In addition, they can realize more environmental benefits through increased system efficiency.

The Biogas Digesters Market for Power Production

Power production continues to be the most popular use for biogas, usually through combined heat and power (CHP) systems. These systems combust biogas in engines or turbines that are connected to generators, turning about 35-40% of the biogas energy into electricity. The worldwide capacity for biogas-to-power has been growing steadily, especially in regions with energy security issues.

As technology has advanced, the cost-effectiveness of producing electricity from biogas has greatly improved. Modern biogas engines are more efficient and reliable, which lowers maintenance costs and downtime. For many farms, generating electricity provides a consistent income through feed-in tariffs or savings on utility bills. This often makes it the primary use that justifies the initial investment in the digester.

Decentralized power solutions, such as biogas systems, are becoming a more common feature in rural electrification programs, particularly in developing regions.

For example, in China, more than 100 million rural residents are now able to use electricity generated by biogas facilities. This demonstrates how scalable and reliable this technology is in meeting basic energy needs in areas where infrastructure is limited.

Case Study: Bavarian Dairy Farm Cooperative

A Bavarian cooperative of 12 dairy farms installed a central 1.2 MW biogas plant that processes manure and crop residues. The system produces 9,500 MWh of electricity each year, which is enough to power 2,700 homes, and also provides heating for the farms. The cooperative reports a payback period of seven years, after which the system generates approximately €950,000 in annual revenue through Germany's renewable energy feed-in tariff program.

Producing Heat

Heat recovery is a significant opportunity in biogas applications that is often not taken advantage of and could improve the economics of many projects throughout the Biogas Digesters Market.

Combined heat and power (CHP) systems can capture up to 45% of the energy from biogas as thermal energy. This thermal energy can be used for heating spaces, heating processes, or even cooling through the use of absorption chillers.

The economics of using heat are heavily dependent on how close the heat demand is, as thermal energy cannot be transported efficiently over long distances.

For facilities that process food, dairies, and other operations that require consistent heat, recovering this “waste heat” can greatly improve the overall efficiency of the system and the economic return.

Converting Vehicles to Biogas

The transportation industry is a growing area for biogas usage, with refined biogas (biomethane) acting as a direct substitute for compressed natural gas (CNG) or liquefied natural gas (LNG) in vehicles. This necessitates additional processing to eliminate CO₂ and other contaminants, raising the methane content to 95-98%.

Even with the extra refining costs, which can vary from $9-16 per MMBtu depending on the area and size of the facility, vehicle fuel is often the most valuable use for biogas. City bus fleets, garbage collection vehicles, and heavy-duty trucks are some of the early adopters, with some cities in Europe now running their entire public transportation fleets on locally-produced biomethane.

Injecting Biomethane into the Natural Gas Grid

Grid injection is a process that allows biogas producers to turn their biogas into biomethane that is of the same quality as natural gas. This means it can be transported through the existing gas infrastructure and used by anyone on the network. While this application can command premium prices, it requires the most upgrading to meet strict quality standards. The European market, led by countries like Germany, Sweden, and the UK, has led the way in this application, establishing regulatory frameworks specifically to make biomethane grid injection easier. The flexibility of grid injection makes it particularly attractive for larger biogas installations that may produce more energy than can be used locally.

From Household to Industrial Scale: The Broad Scope of Biogas Digesters

Biogas digesters come in all sizes, from small household systems that process kitchen waste to large industrial systems that handle thousands of tons of organic material every day. The ability to scale is one of the key benefits of biogas technology. It can meet the needs of waste management and energy production in a variety of contexts and at different investment levels.

There are significant differences in economic and technological choices across these scales, with larger systems generally benefiting from economies of scale in both capital costs and operational efficiency. However, smaller systems offer advantages in terms of reduced transportation requirements for feedstock and simplified permitting processes. The market shows healthy growth across all segments, with particular innovation happening at both the smallest and largest extremes.

Home Biogas Systems ($11 Billion by 2032)

The home biogas market is expected to exceed $11 billion by 2032, thanks to new technologies that make these systems smaller, easier to use, and more visually appealing. Today's home digesters are designed to process kitchen food waste and sometimes human waste, typically producing enough biogas for cooking or a small amount of electricity. Companies like HomeBiogas and Sistema.bio have created pre-made, modular systems that require little technical knowledge to install, making this technology accessible to homeowners who are interested in self-reliance and sustainability.

“Home Biodigesters: Sustainable Waste …” from www.homebiogas.com and used with no modifications.

Small-Scale Farming

One of the most established and rapidly expanding sectors of the market is agricultural biogas, with dairy and livestock businesses at the forefront of adoption. These systems usually process manure, crop residues, or food processing waste, generating enough energy to power farm operations and even sell the surplus. Small-scale digesters provide several revenue streams, including sales of electricity, tipping fees for accepting waste from outside, and valuable digestate that lowers the cost of fertilizer. The economic model is particularly attractive for operations with high energy costs or those located in areas with strong incentives for renewable energy production.

Industrial and Municipal Facilities

Industrial biogas plants are typically used by food processors, breweries, municipal waste authorities, and wastewater treatment facilities. These systems usually process between 50-500 tons of organic material per day and can generate several megawatts of power. The benefits of these systems include cost avoidance for waste disposal, energy generation, and often regulatory compliance with organics diversion mandates. Municipal wastewater treatment plants have been particularly successful with biogas implementation, with many achieving energy neutrality or even becoming net energy producers through efficient digester operation.

Large-scale Projects (Over 3 MW to Hit $2 Billion)

The most significant biogas plants, often with a capacity of more than 3 MW, represent an expanding market segment that is expected to hit $2 billion within the projected period. These plants usually process a variety of feedstock streams from several sources, establishing centralized biogas hubs that meet regional waste management requirements while generating substantial energy. Major waste management firms and energy utilities are increasingly moving into this area, introducing sophisticated project financing models and operational expertise. These large-scale projects benefit from economies of scale that can significantly lower per-unit production costs, although they face obstacles in feedstock logistics and often necessitate complex permitting processes.

What's Going In: Feedstock Trends

The biogas industry is seeing some changes in what's being used as feedstock. The availability, cost, and potential yield of biogas from different materials are all crucial to the financial success of a biogas project. The industry is seeing a shift towards using materials that produce a lot of biogas and strategies that combine different materials to optimize biogas production. The choice of feedstock is increasingly being influenced by both financial considerations and sustainability goals. There's a growing focus on using materials that would otherwise cause environmental problems if they weren't disposed of properly.

Farming Waste

Leftovers from farming practices continue to be the mainstay of the global biogas sector, with animal waste being the primary ingredient for systems based on farms. Waste from animals offers several benefits, including a steady supply, minimal requirements for pre-treatment, and costs for acquisition that are either zero or negative. However, its relatively low yield of biogas compared to other ingredients (typically 25-40 m³ of biogas per ton) means that many systems based on farms are increasingly adopting strategies of co-digestion. Leftovers from crops like corn stalks, wheat straw, and damaged or surplus silage supplement animal waste in many farming systems, providing higher carbon content that boosts the production of methane while addressing challenges of waste management in farming.

Leftovers from the Food Industry

Waste from food processing is one of the most valuable resources for producing biogas, with some materials producing more than 150 m³ of biogas per ton. Waste from dairy processing, slaughterhouses, breweries, and fruit/vegetable processing is especially valuable due to its high energy content and biodegradability. The food industry is increasingly seeing anaerobic digestion as a better alternative to traditional disposal methods, with many processors either installing digesters on their own sites or partnering with biogas facilities. These arrangements often generate revenue through tipping fees while also helping food companies meet sustainability goals related to waste diversion and reducing their carbon footprint.

City Waste

City waste, or municipal solid waste (MSW), is becoming an increasingly popular category of feedstock as cities begin to implement programs that separate organic materials at their source. When properly separated and processed, the organic fraction of MSW can produce 80-140 m³ of biogas per ton. However, contamination with non-organic materials is still a major challenge. Advanced pre-treatment systems, such as optical sorting technology and physical separation processes, are making MSW a more viable option as a biogas feedstock. For municipalities that are struggling with increasing landfill costs and diversion mandates, biogas production is an attractive alternative that turns a disposal problem into an energy resource.

Sewage Sludge

The use of sewage sludge digestion is one of the oldest and most common applications of biogas, with thousands of wastewater treatment plants worldwide using this technology. Although sludge typically produces less biogas per ton than food waste (approximately 30-50 m³), its consistent availability and the operational need for sludge treatment make digestion particularly attractive for wastewater utilities. Advanced techniques such as thermal hydrolysis pre-treatment can increase biogas yields from sludge by 25-50%, improving the economics of these systems. The integration of food waste co-digestion at wastewater treatment facilities is a growing trend, allowing these facilities to increase biogas production using existing infrastructure.

Organic Waste (6% Annual Growth)

With a projected annual growth rate of nearly 6% through 2032, the organic waste biogas segment is expected to outperform the market as a whole. This segment includes a variety of materials, such as food waste from consumers, yard trimmings, and commercial organics from restaurants and grocery stores. The growth of this segment is fueled by the increasing number of organics diversion regulations in many areas, which either ban or discourage the landfilling of biodegradable materials. The infrastructure for collecting these materials is also improving, with specialized containers, vehicles, and transfer stations that are specifically designed to handle organic waste. Although the diverse nature of these materials poses challenges for processing, their high biogas potential (usually 100-150 m³ per ton) makes them an increasingly appealing option as digester operators become more skilled at pre-treatment and mixing strategies.

Why You Should Invest in the Biogas Market

The biogas industry offers a wide range of investment opportunities, from manufacturing equipment to developing and operating projects. The industry is expected to grow to $128.6 billion by 2032, and investors are beginning to see biogas as a mature renewable technology with a high return on investment. This industry is especially attractive to those looking for investments that not only generate stable cash flow but also have a strong environmental impact.

Infrastructure funds, private equity firms, and strategic corporate investors are all expanding their presence in this space. Unlike more volatile renewable sectors such as solar and wind, biogas benefits from relatively predictable feedstock costs and revenue streams. Many projects secure long-term contracts for both waste processing and energy sales, providing revenue certainty that can extend 10-20 years.

There are investment opportunities in both greenfield development and operational asset acquisition. As the industry matures, consolidation is happening, with larger players buying successful smaller operators to build regional and national platforms. This trend is especially clear in Europe and North America, where favorable regulatory environments have allowed early movers to show profitable business models.

Investors are increasingly turning to emerging markets for biogas opportunities, where there is a wealth of untapped potential in regions with plentiful organic waste and rising energy needs. Countries such as India, Brazil, and Kenya are putting in place supportive policies that not only make projects more financially viable, but also tackle key issues in waste management and energy access.

- Equipment manufacturing (digesters, gas upgrading systems, monitoring technology)

- Project development (greenfield development, expansions, acquisitions)

- Operational management (specialized biogas plant operations services)

- Feedstock supply chain development and management

- End-product marketing (electricity, heat, vehicle fuel, fertilizer)

Strategic Partnership and Collaboration Models

Successful biogas ventures increasingly rely on strategic partnerships that align complementary capabilities and resources. Waste management companies partner with energy utilities to leverage their respective expertise in feedstock sourcing and energy marketing. Agricultural cooperatives form joint ventures with technology providers to implement digesters serving multiple farms. Food processors collaborate with biogas developers to create closed-loop systems that process their waste while returning energy to their operations. These partnership models distribute risk while creating value chains that would be difficult for any single entity to establish independently.

Return on Investment Analysis Compared to Other Renewable Energy Sources

Internal rates of return (IRR) for biogas projects usually range from 8-20%, depending on the size of the project, the cost of feedstock, and local incentives. While these returns may sometimes seem lower than those for solar or wind projects in ideal locations, biogas investments often have more stable cash flows with less variation depending on the season or weather. The revenue model for multiple products, which combines tipping fees, energy sales, and fertilizer value, provides diversification that can reduce the overall risk of the project.

For most commercial biogas installations, the payback period is 3-10 years, with smaller systems usually falling at the longer end of this range. Larger facilities benefit from economies of scale that can significantly improve returns, especially when incorporating biogas upgrading for higher-value applications like vehicle fuel or grid injection. When accounting for all the benefits, including the cost of avoiding waste management and carbon credits, the financial case for biogas is significantly stronger than other renewable energy options.

Assessing Risks and Strategies for Mitigation

Key Risks for Biogas Investment

Category of Risk Specific Types of Risk Typical Mitigation Strategies Feedstock Interruptions in supply, price instability, inconsistent quality Contracts for long-term supply, diversified sources, capabilities for pre-processing Technology Shortfalls in performance, issues with maintenance, obsolescence Selection of proven technology, warranties that are comprehensive, implementation in phases Regulatory Changes in incentives, delays in permitting, requirements for compliance Diversification across jurisdictions, active participation in industry associations, conservative models for finance Market Fluctuation in energy prices, displacement due to competition, demand for end-products Agreements for long-term offtake, diversification of products, focus on revenue from waste processing Operational Disruptions in processes, challenges with staffing, incidents related to safety Monitoring remotely, programs for preventive maintenance, training that is comprehensive

Investors in biogas who are successful implement strategies for managing risk that are comprehensive and address uncertainties at the level of the market and the specific project. The risk related to feedstock, often cited as the most critical factor, can be mitigated through strategies for diversification that incorporate multiple streams of waste. The risk related to technology continues to decline as the industry matures and data on performance from thousands of plants that are operational becomes available. Risks that are regulatory remain significant in some markets, though the trend toward policies that are supportive for gas that is renewable appears robust across most regions.

There is an increasing trend in financial structures to include risk-sharing mechanisms to align incentives across the value chain. This includes pricing that varies based on performance metrics, allowing key partners to participate in equity, and investing in stages that allow for proof-of-concept before deploying on a full scale. Insurance products designed specifically for biogas facilities are also becoming more common, covering risks ranging from business interruption to environmental liability.

The savviest investors run in-depth scenario analyses that simulate project performance under a range of feedstock, technology, and market circumstances. This method provides a realistic evaluation of downside risks and identifies the main performance indicators that can activate intervention strategies if projects do not meet expected results.

Obstacles and Resolutions for Biogas Adoption and How they Affect the Biogas Digesters Market

Regardless of its persuasive advantages, biogas technology encounters several continuous obstacles that have restrained adoption rates in some regions and applications. Industry stakeholders are vigorously creating resolutions to tackle these barriers, with significant advancement apparent in recent years. The most effective methods combine technological inventions with business model alterations and policy advocacy to establish more advantageous circumstances for biogas deployment.

High Initial Installation Costs

The cost of installing biogas facilities is the main barrier to wider adoption, especially for smaller potential users. Installation costs typically make up 70-95% of the total costs of a biogas project, making it a significant financial hurdle despite the attractive long-term economics. To address this challenge, innovative financing models are emerging, including equipment leasing, build-own-operate arrangements, and energy-as-a-service contracts that eliminate or reduce upfront costs. Standardized, modular system designs are also helping to reduce the capital required by making the engineering and construction processes more efficient and enabling mass production efficiencies for key components.

Need for Skilled Professionals

Biogas systems demand particular skills for effective design, operation, and maintenance—skills that many potential users do not possess. This lack of knowledge has traditionally hindered adoption, particularly in smaller applications and developing regions. The industry is responding with simplified, automated systems that reduce the need for operator intervention. Remote monitoring technologies now allow expert oversight of multiple facilities, enabling centralized technical support teams to manage distributed biogas assets efficiently. Training programs specifically focused on biogas operation have expanded, with industry associations and equipment providers offering certification pathways that create skilled workforce development pipelines.

Steady Supply of Feedstock

For many biogas operators, especially those who depend on external sources of feedstock, the constant availability of suitable organic materials is a struggle. The supply can be disrupted due to seasonal changes in agricultural waste, competition from alternative uses, and issues with transportation logistics. However, project developers who are planning for the future are introducing multi-feedstock capabilities. These allow facilities to process a variety of organic materials, providing flexibility in operations when the availability of the primary feedstock fluctuates. In some areas, regional feedstock aggregation hubs are being developed. These hubs provide a more reliable supply chain for smaller digesters that do not have the scale to source their own materials efficiently. Digital platforms that connect waste generators with biogas facilities are also showing potential for optimizing logistics and reducing costs.

Regulatory Obstacles May Slow the Biogas Digesters Market

Many jurisdictions pose regulatory challenges for biogas projects due to complex permitting processes, inconsistent incentive structures, and interconnection barriers. This often leads to longer development timelines and increased costs, especially for first-time developers who are unfamiliar with local requirements.

However, industry associations have made significant progress in advocating for streamlined permitting pathways and consistent renewable gas standards.

Some regions have even implemented one-stop permitting approaches specifically for biogas facilities, acknowledging their unique position at the intersection of waste management and energy regulation. To navigate these complexities efficiently, developers are increasingly engaging experienced regulatory consultants early in the project planning process.

Biogas: What's in Store for 2025-2037

With the biogas industry at a critical juncture, the convergence of technological advancements and increasing awareness of its potential to address climate and waste management issues is expected to bring about significant changes.

Looking ahead to the Biogas Digesters Market in 2025-2037, a number of transformative trends are expected to reshape the sector. Biogas capacity is expected to more than double during this period, reaching approximately 45-50 gigawatts globally by 2037. The technology mix is expected to change significantly, with an increasing focus on biomethane production for grid injection and transportation applications.

Digitalization is expected to revolutionize operations, with AI-driven process optimization becoming standard across larger facilities. Geographic expansion is expected to continue, with particularly strong growth in Southeast Asia, Latin America, and parts of Africa where organic waste streams are abundant but currently underutilized.

Most importantly, biogas is expected to be increasingly recognized not simply as a waste management solution or energy source, but as a crucial component of circular economy models that maximize resource utilization while minimizing environmental impacts.

Commonly Asked Questions on Biogas Digesters Market Trends

As biogas technology becomes more popular, those who are considering adopting it often look for information about the practical aspects of its implementation. The questions below address common concerns about the costs, performance, and operational requirements of biogas digesters in various applications and scales.

By understanding these basics, organizations and individuals can determine if biogas technology is a good fit for their specific situation and goals.

What is the price range for biogas digester installation?

The cost of installing a biogas digester can vary greatly depending on its size, the type of technology it uses, and where it is located. Small residential units usually cost between $500 and $5,000, especially if they are pre-fabricated systems for individual households.

On a farm, a digester that can process manure from 200 to 500 dairy cows typically costs between $400,000 and $1.5 million, with the price dependent on how advanced the gas utilization equipment is. Industrial-sized systems that can process over 50 tons of material each day can require an investment of $5 to $20 million. The cost can be affected by the requirements for pre-treating the feedstock, the systems for utilizing the biogas, and the local construction costs.

Economies of scale have a significant impact on the cost per unit in the Biogas Digesters Market. Installation costs for larger systems generally fall between $3,000 and $5,000 per kilowatt of electrical capacity. In contrast, smaller installations can exceed $8,000 to $10,000 per kilowatt.

These numbers explain why larger projects often have better economics. However, advancements in standardized, modular designs are gradually improving the economics of small-scale systems.

What types of waste are best for biogas digesters?

While almost any organic material can produce biogas through anaerobic digestion, some feedstocks provide significantly higher yields and better process stability. Food waste typically has the highest biogas production potential, with yields often exceeding 120-180 cubic meters per ton. Animal manures provide excellent process stability due to their inherent microbial communities, though their biogas yield is lower at approximately 20-60 cubic meters per ton.

Fats, oils, and greases generate exceptional methane content but require careful monitoring to avoid process inhibition. Agricultural residues like crop stalks and straw contain significant energy potential but often require pre-treatment to break down lignocellulosic structures that resist microbial degradation.

The ideal approach for many digesters is co-digestion, combining complementary materials to optimize both process stability and gas production while managing seasonal availability fluctuations.

What is the ROI period for a biogas digester?

The ROI period for a biogas digester can be quite variable, depending on factors such as the size of the facility, local energy costs, available incentives, and the cost of feedstock. In the best case scenario, with supportive policies in place, large commercial digesters can see a return on investment in as little as 3-5 years.

More commonly, the ROI period is between 5-8 years for well-managed systems with a reliable supply of feedstock and energy off-take arrangements. Smaller systems usually have a longer ROI period, but this can be mitigated by grants and incentives aimed at promoting small-scale renewable energy, which can significantly improve the financial viability of the system.

Financial viability is often determined by multiple revenue streams. Many projects generate income not just from energy production, but also from waste disposal tipping fees, carbon credits, and digestate sales as fertilizer. In some cases, the main economic driver is not direct revenue, but avoided costs, such as reduced expenses for wastewater treatment or fertilizer purchases.

Projects that are the most profitable in the Biogas Digesters Market usually have at least two of these features: no-cost or negative-cost feedstock, high energy costs or favorable feed-in tariffs, significant waste disposal cost savings, and efficient use of both biogas and digestate. Projects that maximize all available value streams consistently achieve the shortest payback periods and highest returns on investment.

Is there any government support for biogas digester installation?

Government support for biogas projects varies widely by region but has generally strengthened as more jurisdictions recognize biogas's contributions to renewable energy and waste management goals.

Common incentive mechanisms include capital grants covering 15-50% of installation costs, production-based incentives such as feed-in tariffs or renewable energy credits, tax incentives including accelerated depreciation and investment tax credits, and low-interest financing programs specific to renewable energy or agricultural improvements.

In the U.S., the Rural Energy for America Program (REAP) is a federal program that provides grants and loan guarantees that are specifically applicable to farm-based digesters. Many states offer additional incentives through renewable portfolio standards that recognize biogas as an eligible resource.

The European Union Biogas Digesters Market has some of the world's most comprehensive biogas support mechanisms, with countries like Germany, Italy, and Denmark offering particularly favorable conditions through combinations of feed-in tariffs, investment subsidies, and carbon pricing that improves relative economics versus fossil alternatives.

What type of upkeep do biogas digesters need?

For a biogas digester to work efficiently and last a long time, it needs to be well-maintained. Everyday tasks usually involve checking important factors like temperature, pH, gas production, and feedstock input rates. Regular lab testing of digestate can help spot potential process imbalances before they affect performance. Physical upkeep tasks include servicing pumps and mixers, inspecting pipes and valves, and checking the gas handling system to stop leaks or pressure problems. For more insights into the biogas industry, you can explore the biogas market analysis.

Devices that use biogas, like engines or upgrading systems, usually need the most frequent maintenance, with similar intervals to other industrial equipment. Most combined heat and power units need regular service every 2,000 to 4,000 hours of operation, with significant overhauls typically happening at intervals of 20,000 to 60,000 hours, depending on the specific technology. For more on biogas technology, explore the best CO2 separation membrane tech for the biogas industry.

Today's systems are increasingly being equipped with remote monitoring capabilities, allowing operators to track performance metrics in real time. This allows for predictive maintenance strategies that can address potential problems before they lead to failures. For smaller systems, simplified designs that reduce the number of moving parts and computerized controls have significantly reduced maintenance needs. This makes the technology more accessible to operators with limited technical resources.

The cost of thorough maintenance programs usually falls between 2-5% of the original capital investment each year. However, this cost can fluctuate based on the complexity of the system and the local labor costs. Many larger facilities choose to keep service contracts with equipment suppliers or specialized biogas service companies. This ensures the best performance and a quick response to any operational problems.

Biogas Systems Maintenance Checklist

Every day: Keep an eye on gas production, pressures, and temperatures, and look for leaks

Every week: Check digestate parameters, mixers, and pumps, and clean gas filters

Every month: Look at safety systems, maintain generators, and calibrate monitoring equipment

Every quarter: Look at structural integrity, service pumps and valves, and analyze gas composition

Every year: Look at tank integrity, overhaul key components, and update operating procedures

Adopting biogas technology necessitates thorough preparation and consistent dedication, but the environmental and economic advantages make it an increasingly appealing option for businesses and communities looking for sustainable waste management and energy solutions. As technology continues to progress and market conditions change, biogas digesters are set to play a growing part in our renewable energy future.