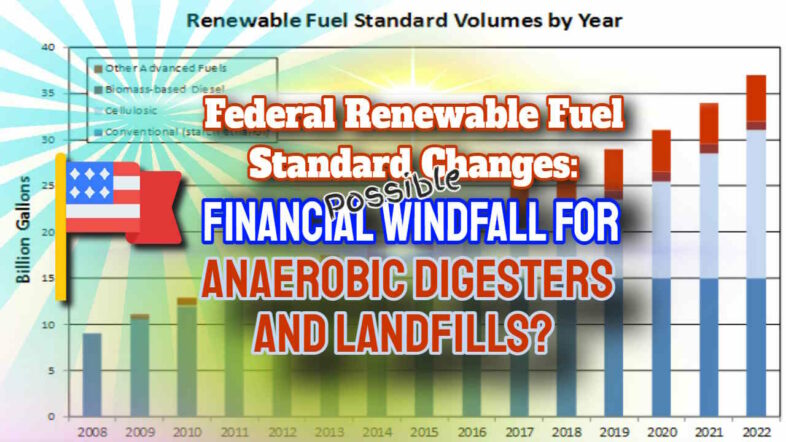

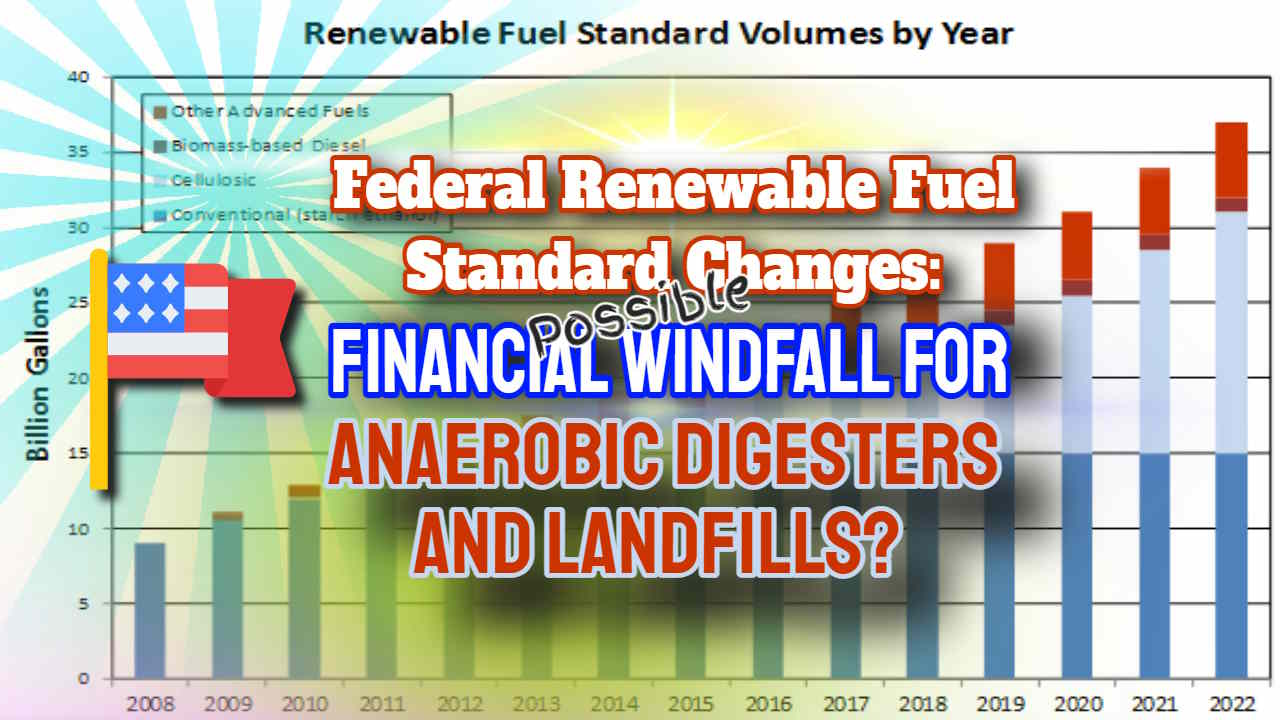

Depending on how the final details shake out during 2023, proposed changes to the federal Renewable Fuel Standard programme could be a financial boon for operators generating energy from anaerobic digesters and landfills.

Introduction

The proposed changes to the federal Renewable Fuel Standard (RFS) program in the US could be a financial opportunity for operators generating energy from anaerobic digesters and landfills.

Established in 2005 as part of a Clean Air Act amendment, the RFS program aims to reduce transportation emissions by setting targets for the use of renewable fuels to replace or reduce petroleum-based transportation fuel. In order to meet the Environmental Protection Agency's (EPA) annual volume targets, refiners and importers of gasoline and diesel fuel must obtain credits known as Renewable Identification Numbers (RINs).

The fluctuating values of RIN credits have benefited waste facility operators in the past. However, with the EPA's recent proposal to establish an eRIN program aimed at electric vehicles, waste facility operators are expected to benefit even more from the program. Despite concerns raised by industry groups, the EPA is expected to finalize its plans by June 2023.

What is the Renewable Fuel Standard (RFS)?

The RFS was established in 2005 as part of a Clean Air Act amendment, with the goal of reducing transportation emissions by setting targets for the use of renewable fuels to “replace or reduce the quantity of petroleum-based transportation fuel, heating oil, or jet fuel.”

In order to meet the EPA's annual volume targets, refiners and importers of gasoline and diesel fuel must obtain credits known as renewable identification numbers (RINs).

RIN credits have benefited waste facility operators, but political complications in setting annual volume targets have resulted in fluctuating values. But now, for the first time, the EPA, along with the Departments of Energy and Agriculture, is setting multiyear volume targets through 2025, rather than annual updates. Along with other significant changes, the EPA's recent proposal would establish an eRIN programme aimed at electric vehicles.

During a recently concluded public comment period, the agency received numerous suggestions, with the goal of finalising plans in June.

RFS Compliance and RIN Values: How Annual RVOs Impact Renewable Fuel Program

Compliance in the RFS programme is driven by fossil fuel companies blending renewable fuels into their products or purchasing RINs to meet RVO targets. The annual RVOs have a direct impact on RIN values.

Based on current market conditions, the EPA projected a 13.1% year-over-year increase in RNG volumes for RINs derived from cellulosic biofuel for compressed or liquid natural gas used in transportation.

Industry Groups Criticize EPA's RFS Expansion Targets as Falling Short

Industry groups welcome the EPA's expansion of the programme but believe its targets fall short.

“”We're concerned that the rules only use a one-year growth rate,” was the response of Sam Wade, director of public policy for the RNG Coalition, citing pandemic and supply chain effects. The group, which is generally in favour of the program's expansion, suggests a 30% growth rate, which Wade believes is reasonable “more realistic and more accurately reflects what the RNG industry can do in this space.”

The RNG Coalition, which claims to have 276 active RNG sites in North America, is advocating for a regulatory mechanism that would automatically adjust annual RVO targets, and its comments cited numerous examples of expansion. The sector is seeing significant ESG-driven investment on top of existing state and federal incentives, such as the 2022 Inflation Reduction Act. Another 114 projects are currently under construction, with another 150 planned.

US Waste Industry Advocates Push for Higher Growth Rates in EPA's RFS Expansion Plan

The National Waste & Recycling Association and the Solid Waste Association of North America both advocated for a “minimum” growth rate of 30.4%, citing $2 billion in planned RNG investments by the waste industry's top three companies alone.

Waste Management Inc. Boosts RNG Spending in Response to RFS and Federal Incentives

Waste Management Inc. (WM) recently increased its planned RNG spending for the next three years by $390 million, citing the RFS and other federal incentives. Senior Counsel and Director of Regulatory Affairs Michael Jensen stated in prepared testimony for a January RFS hearing that these factors have “created a favourable environment for our sector to explore additional investment in RNG and biogas production infrastructure.”

Companies Seek to Influence EPA's Thinking on Biogas Assets and RNG Generation Projections

Given these trends, some companies hope to influence the EPA's thinking.

“We're seeing the increasing value of biogas assets now with multiple paths to monetization,” was the reaction from Noah Kaye, an Oppenheimer senior research analyst. They said that they heard that some players are certifying their construction pipelines with the EPA in an effort to boost RNG generation projections.”

According to sources, the agency (EPA) must strike a delicate balance. Raising the RVO targets too far may result in litigation from energy companies, as has happened in the past. Setting them too low may cause the RIN market to crash.

“”They need to err on the side of being aspirational, and there are a lot of reasons to support being more aspirational, especially in the last 12 months,” said Patrick Serfass, executive director of the American Biogas Council. His organisation is advocating for a minimum growth rate of 20%, claiming that the current proposal “seems out of touch with even slow pandemic years.”

But EPA's Proposal for eRIN Credits Sparks Controversy and Concerns in Renewable Energy Industry

The ability to generate RINs from renewable energy systems in 2024 is a long-awaited update that may be particularly relevant to the waste industry. However, the agency's proposal to manage eRIN credits through light-duty EV manufacturers rather than energy producers has been met with strong opposition.

The EPA believes that limiting the number of parties involved in this new programme will be beneficial. Biogas trade groups and others are concerned that the move to limit control of eRIN credits is not rational, and that one major EV player — Tesla — will wield undue influence. There has also been discussion about how the regulations might affect landfills that generate electricity as well as RNG.

Landfill Operators Poised to Benefit from eRIN Programme Despite Controversy

Nonetheless, observers believe the programme would benefit landfill operators because they would be able to share in the RIN value, as they would with a third-party RNG developer. Some landfill operators may receive a larger share of the eRIN value depending on how final eRIN volume targets are calculated and how the market responds.

According to ABC, approximately 2,000 of the estimated 2,300 operating biogas systems in the United States generate electricity. Within the landfill sector, gas systems are more commonly used to generate electricity than RNG.

WM has dozens of these operations in place, dating back to its first project in 1987. Due to the proposed RFS changes, the company recently announced that it will keep two sites in this category rather than converting them to RNG sites as planned.

“This, we believe, will be a significant revenue stream for us long term. It's a great example of our ability to own these facilities, invest in them, and retain their value. “We're now in a position to optimise the value with this pathway,” said Tara Hemmer, Chief Sustainability Officer, during a recent earnings call.

Republic Services Pushes For Medium- And Heavy-duty Evs To Be Included In Erin Programme

Republic Services sees potential in eRINs as well, citing similar industry logistics concerns, but wants the EPA to go further. The company, which has aggressive fleet electrification goals, stated that leaving medium- and heavy-duty EVs out of the programme is a “significant oversight and missed opportunity.”

During a quarterly earnings call on Wednesday, Republic CEO Jon Vander Ark was of the opinion that the as the “vast majority” of the company's landfill gas projects currently generate electricity and could benefit from the eRIN programme This is the case particularly if they are used to power the company's fleet. He also stated that BP, a joint venture partner in many upcoming landfill gas projects, was “open-minded” about the potential.

“With eRINs coming online, we've got option value,” Vander Ark indicated that they see it as a long-term benefit for them because it will provide two pathways.”

While large competitors, such as WM, are still more focused on CNG vehicles that are already part of the RFS system, EV adoption in the industry is expected to grow significantly in the future.

Biomass Facilities May Be Added To Erin Programme, Covanta Requests Inclusion

Another change could occur if the EPA decides to include biomass facilities in the eRIN programme in the future. Covanta is among those requesting that the exclusion of facilities such as its mass burn combustion sites from the upcoming expansion be reconsidered. In comments, it stated that doing so would be “consistent with the Clean Air Act's feedstock neutral intent” and would help to correct the “EPA's inconsistent treatment of landfill biogas and WTE.”

Proposed Changes To Erin Programme Could Positively Impact Anaerobic Digestion Plants And Feedstock Blending

Food waste processing and the output from anaerobic digestion plants is increasing. While all of these proposed changes will affect landfill operators, they will also have an impact on anaerobic digesters.

Currently, digesters that process wastewater and manure generate higher-value RINs (via a code based on feedstock types). However, if food waste is included, the entire project will only generate a lower-valued RIN type. The EPA would now have more nuance in the credits for blended feedstocks under a proposed update.

This could be a significant shift for local governments or co-digestion companies like Anaergia. Yaniv Scherson, the agency's chief operating officer, expressed delight in “setting a precedent and a pathway for feedstock blending,” calling current rules “a barrier to co-digestion, which is a big potential synergy in the industry.”

Proposed RFS Changes Could Boost Food Waste Recycling Efforts

Similarly, groups like ABC believe that the proposed RFS changes will increase the amount of food scraps recycled.

“”The combination of eRINs, as well as the ability to add food waste without taking a credit reduction, are two really new things that could potentially change the waste industry,” Serfass said.

Future Challenges For Epa In Finalizing Updates To RFS Program

Looking forward the EPA will be dealing with numerous other issues raised by industry groups regarding compliance timelines, modelling estimates, storage requirements, and other issues as it works to finalise its updates for this highly complex programme. It must also deal with criticism from environmental organisations, among others.

Bright Future for RNG in the Voluntary Market

Aside from this potential regulatory boost, trade groups and companies see an even brighter future for RNG in the so-called voluntary market.

RNG demand has increased as ESG-driven businesses seek to reduce emissions from energy consumption for heat or power. Long-term offtake agreements are becoming more popular, as evidenced by comments from BP following its acquisition of Archaea and recent updates from landfill companies. Anaergia, for example, highlighted a deal with Irving Oil of Canada to purchase RNG from its digester in Rhode Island.

“What's really going to put jet fuel into the RNG industry is the voluntary market,” was the opinion of Scherson, who predicts that RIN values will be much less important in five years. “This programme will become significantly less relevant to the RNG industry.”

RNG Demand Expected to Rise Rapidly in Non-transportation Sector

Other trade groups and companies agree that non-transportation demand for RNG will skyrocket. Meanwhile, Kaye stated that RNG values in regulatory compliance markets continue to be higher, though he expects more convergence over time.

“”Investors are keeping a close eye on what this all means for waste companies' investment plans, capital allocation strategies, and economics,” Kaye said. “The picture is hazy, but it's upbeat.”

Conclusion

The federal Renewable Fuel Standard (RFS) programme could be a financial benefit for operators generating energy from anaerobic digesters and landfills if the final details are successful. The RFS was established in 2005 as part of the Clean Air Act amendment, with the goal of reducing transportation emissions by setting targets for the use of renewable fuels.

The EPA, along with the Departments of Energy and Agriculture, is now setting multiyear volume targets through 2025 rather than annual updates.

The proposal would establish an eRIN programme aimed at electric vehicles. While some industry groups and observers believe the program's expansion targets fall short, others advocate for higher growth rates.

Despite some controversy, the eRIN programme will be expected to benefit both biogas plant and landfill operators as they would share in the RIN value.

It might even prove to be a windfall!