This article provides definitions and explanations of the Renewable Gas Certificates: Renewable Energy Guarantees of Origin (REGOs), Renewable Gas Guarantees of Origin (RGGOs), and Renewable Transport Fuel Certificates (RTFCs) within the context of the biogas industry biomethane and the renewable energy market, differentiating between their roles in compliance and voluntary markets.

These certificates are crucial mechanisms for tracking, verifying, and incentivising the production and use of renewable energy and fuels derived from biogas. The first stage for understanding them is to learn the acronyms for each of the Renewable Gas Certificates. Read on to find out more:

Key Takeaways: Renewable Gas Certificates

Certificate Types & Applications

- REGOs (Renewable Energy Guarantees of Origin) track renewable electricity generation – each certificate represents 1 MWh

- RGGOs (Renewable Gas Guarantees of Origin) certify renewable gas like biomethane injected into gas grids

- RTFCs (Renewable Transport Fuel Certificates) validate renewable fuels used in transportation

Multiple Revenue Stream Opportunities for Biogas Operations

Biogas generators can create multiple revenue streams by selling certificates separately from the actual energy produced, making projects more economically viable across electricity, gas, and transport fuel applications.

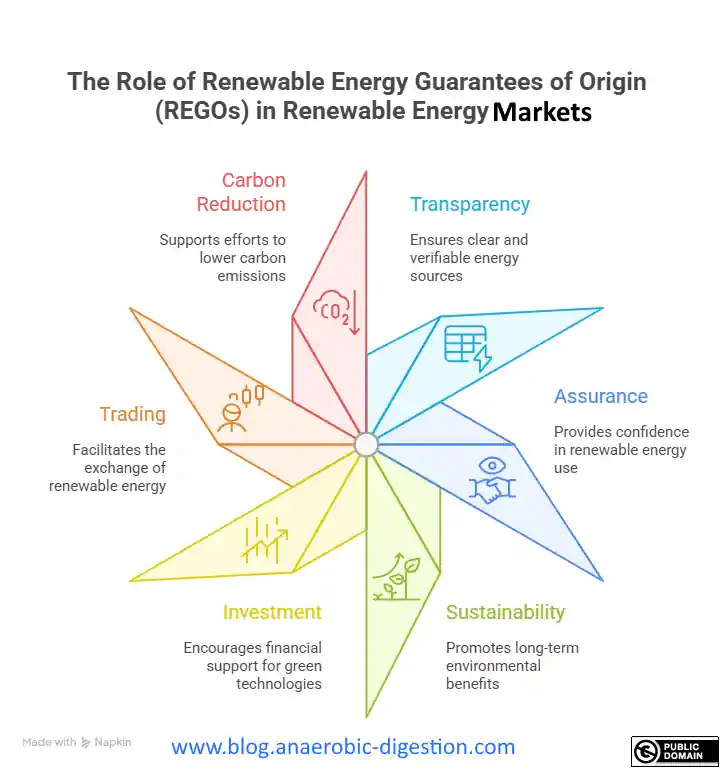

Renewable Energy Guarantees of Origin (REGOs)

Definition

Renewable Energy Guarantees of Origin (REGOs) are electronic certificates that provide proof to electricity consumers that a given proportion of their electricity supply has been generated from renewable sources. Each REGO represents 1 MWh of renewable electricity generated. They are used to track the origin of renewable electricity and prevent double-counting.

Compliance Market

In compliance markets, REGOs are used by electricity suppliers to demonstrate compliance with government mandates, such as Renewable Portfolio Standards (RPS). These standards require suppliers to source a certain percentage of their electricity from renewable sources. Suppliers purchase REGOs to match the amount of renewable electricity they claim to supply to their customers.

For biogas generators, REGOs are issued for each MWh of electricity produced from biogas. The generator can then sell these REGOs separately from the electricity itself, providing an additional revenue stream. This revenue helps to make biogas electricity generation more economically viable.

Voluntary Market

In the voluntary market, businesses and individuals choose to purchase REGOs to offset their electricity consumption and support renewable energy. This allows them to rightfully claim that they are using “green” electricity, even if the physical electricity they consume is not directly from a renewable source.

Biogas generators can sell REGOs to companies looking to meet their sustainability goals or to consumers who want to support renewable energy. The voluntary market provides an additional outlet for REGOs, increasing demand and potentially driving up prices.

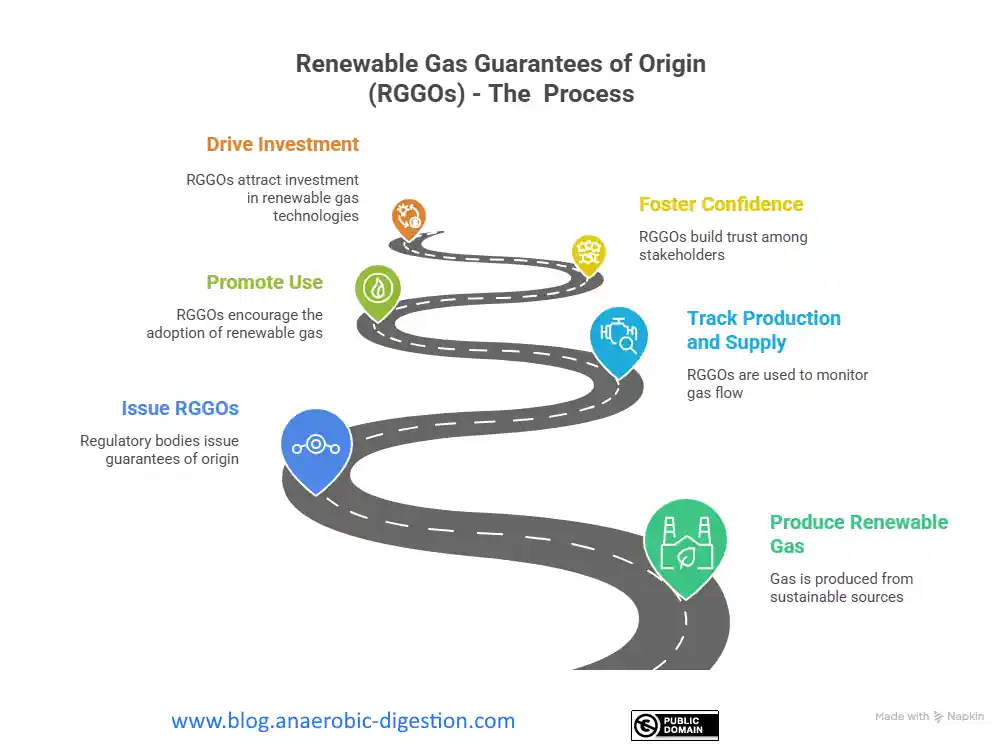

Renewable Gas Guarantees of Origin (RGGOs)

Definition

Renewable Gas Guarantees of Origin (RGGOs) are similar to REGOs, but they apply to renewable gas, such as biomethane. An RGGO certifies that a specific quantity of gas (typically 1 MWh) has been produced from a renewable source. They provide a transparent and reliable way to track the origin of renewable gas injected into the gas grid.

Compliance Market

In compliance markets, RGGOs are used to meet mandates related to renewable gas consumption. For example, some countries have targets for the proportion of renewable gas in the gas grid. Gas suppliers can purchase RGGOs to demonstrate compliance with these targets.

Biogas plants that upgrade their biogas to biomethane and inject it into the gas grid can receive RGGOs for each MWh of biomethane produced. These RGGOs can then be sold to gas suppliers, providing an additional revenue stream for the biogas plant.

Voluntary Market

In the voluntary market, RGGOs are purchased by companies and individuals who want to reduce their carbon footprint by using renewable gas. This allows them to claim that they are using “green” gas, even if the physical gas they consume is not directly from a renewable source.

Biogas plants can sell RGGOs to companies looking to meet their sustainability goals or to consumers who want to support renewable gas. The voluntary market provides an additional outlet for RGGOs, increasing demand and potentially driving up prices.

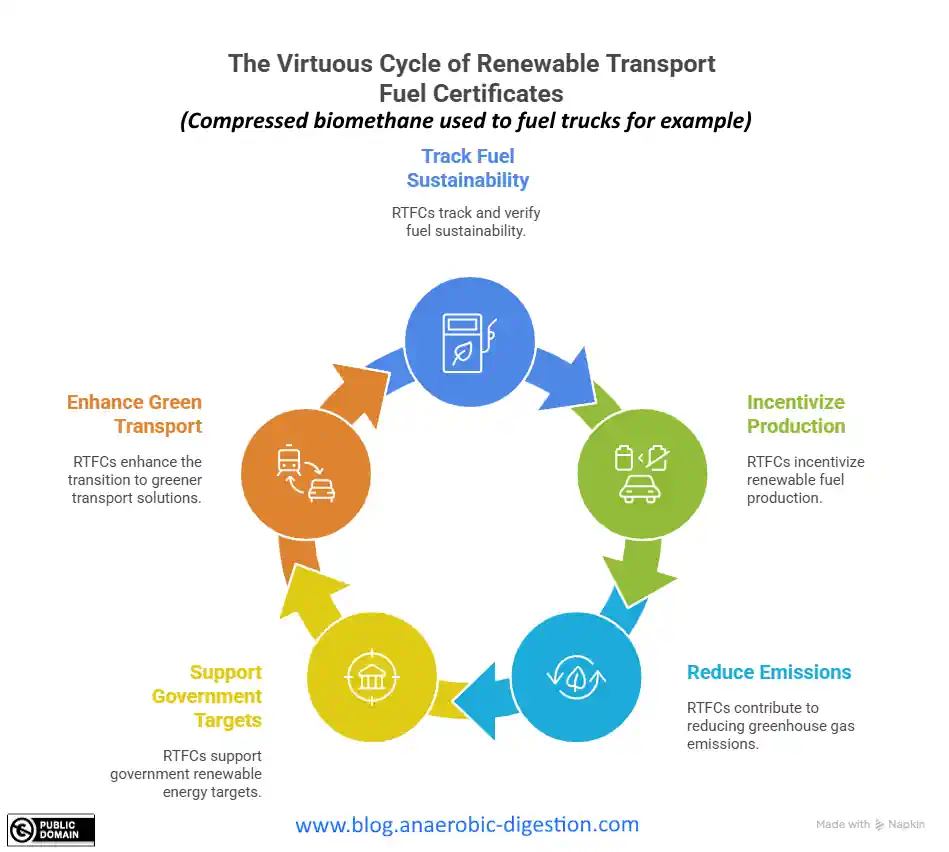

Renewable Transport Fuel Certificates (RTFCs)

Definition

Renewable Transport Fuel Certificates (RTFCs) are issued for renewable fuels used in transport. They are used to demonstrate compliance with mandates that require fuel suppliers to include a certain percentage of renewable fuels in their overall fuel mix. In the UK, for example, the Renewable Transport Fuel Obligation (RTFO) requires fuel suppliers to blend renewable fuels into petrol and diesel.

Compliance Market

In compliance markets, fuel suppliers must acquire a certain number of RTFCs each year to meet their obligations. They can either blend renewable fuels themselves or purchase RTFCs from other companies that have blended renewable fuels.

Biogas plants that produce biomethane for use as a transport fuel can receive RTFCs for each liter of biomethane equivalent. These RTFCs can then be sold to fuel suppliers, providing an additional revenue stream for the biogas plant. The value of RTFCs can significantly improve the economics of producing biomethane for transport.

Voluntary Market

While RTFCs are primarily used in compliance markets, there is a growing interest in using them in the voluntary market. Companies that want to reduce their carbon footprint can purchase RTFCs to offset the emissions from their transport activities.

Biogas plants can potentially sell RTFCs to companies looking to meet their sustainability goals or to consumers who want to support renewable transport fuels. However, the voluntary market for RTFCs is less developed than the voluntary markets for REGOs and RGGOs.

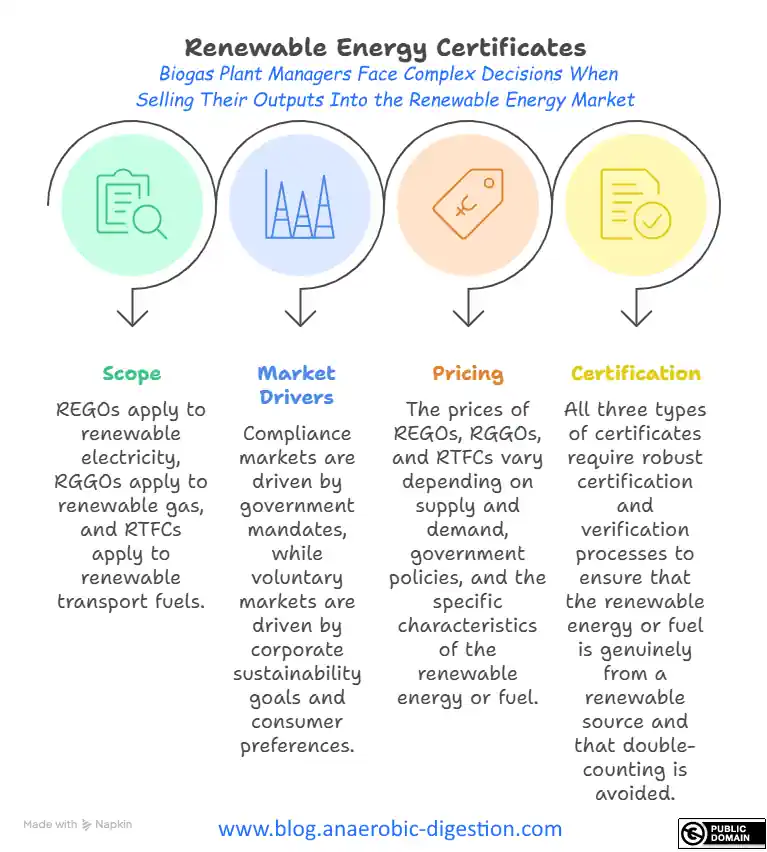

Key Differences and Considerations

Scope: REGOs apply to renewable electricity, RGGOs apply to renewable gas, and RTFCs apply to renewable transport fuels.

Market Drivers: Compliance markets are driven by government mandates, while voluntary markets are driven by corporate sustainability goals and consumer preferences.

Pricing: The prices of REGOs, RGGOs, and RTFCs vary depending on supply and demand, government policies, and the specific characteristics of the renewable energy or fuel.

Certification and Verification: All three types of certificates require robust certification and verification processes to ensure that the renewable energy or fuel is genuinely from a renewable source and that double-counting is avoided.

Conclusion – Renewable Gas Certificates & Acronyms They Are Known By

REGOs, RGGOs, and RTFCs are acronyms that all biogas plant managers should be familiar with. They are important mechanisms for promoting the production and use of renewable energy and fuels from biogas, and not least biomethane.

They provide a way to track the origin of renewable energy and fuels, incentivise investment in renewable energy projects, and enable companies and individuals to reduce their carbon footprint.

Understanding the differences between these certificates and their roles in compliance and voluntary markets is crucial for biogas generators and other stakeholders in the renewable energy sector.

You may also find our article on UK Renewable Energy Market Services helpful.

Frequently Asked Questions about Renewable Gas Certificates

What are the main types of renewable gas certificates?

There are three main types of renewable gas certificates:

- REGOs (Renewable Energy Guarantees of Origin) – for renewable electricity

- RGGOs (Renewable Gas Guarantees of Origin) – for renewable gas like biomethane

- RTFCs (Renewable Transport Fuel Certificates) – for renewable transport fuels

How much energy does each certificate represent?

Each REGO and RGGO certificate typically represents 1 MWh of renewable energy generated. RTFCs are issued per liter of biomethane equivalent for transport fuel applications.

What's the difference between compliance and voluntary markets?

Compliance markets are driven by government mandates that require suppliers to meet specific renewable energy quotas. Voluntary markets serve businesses and consumers who choose to purchase certificates to meet sustainability goals or support renewable energy, even without legal requirements.

How do biogas generators benefit from these certificates?

Biogas generators can sell certificates separately from the actual energy produced, creating additional revenue streams that make projects more economically viable. This applies whether they generate electricity (REGOs), produce biomethane for gas grids (RGGOs), or create transport fuel (RTFCs).

Can I claim to use “green” energy if I buy certificates?

Yes, purchasing renewable gas certificates allows you to legitimately claim you're using “green” energy, even if the physical energy you consume comes from mixed sources. The certificates provide proof that renewable energy equivalent to your consumption has been generated and injected into the grid.

What determines the pricing of renewable gas certificates?

Certificate prices vary based on supply and demand dynamics, government policies, and the specific characteristics of the renewable energy or fuel. Market conditions, regulatory requirements, and corporate sustainability demand all influence pricing.

How do certificates prevent double-counting of renewable energy?

Certificates use robust certification and verification processes to ensure each unit of renewable energy is only claimed once. This tracking system maintains the integrity of renewable energy claims and prevents the same renewable energy from being sold multiple times to different buyers.

Which certificate type is best for transport companies?

RTFCs (Renewable Transport Fuel Certificates) are specifically designed for transport applications and are required for compliance with regulations like the UK's Renewable Transport Fuel Obligation (RTFO). While the voluntary market for RTFCs is less developed than for REGOs and RGGOs, it's growing as companies seek to reduce transport-related emissions.