“UK Biogas History” or the UK anaerobic digestion and biogas production industry to give it a fuller title has been developed from almost nothing over the years since 2000. In this article, we cover the last quarter of a century of the UK Industry's history and recent developments at the beginning of 2025.

Key Points

- The UK biogas industry has transformed from a niche waste management solution to a cornerstone of renewable energy infrastructure

- Technological innovation has dramatically improved process efficiency and product quality

- Integration with other renewable technologies has created new market opportunities

- Policy support has proven crucial for industry development

- The sector now plays a vital role in achieving net-zero targets

The Evolution of UK Anaerobic Digestion: A 21st Century Success Story

Key Fact: By 2025, the UK biogas industry has grown to process over 25 million tonnes of organic waste annually, producing enough biomethane to heat 4.5 million homes and providing sustainable fertilizer for approximately 20% of UK farmland.

The story of anaerobic digestion (AD) in the United Kingdom represents one of the most remarkable transformations in renewable energy technology this century.

From humble beginnings in sewage treatment works of the 1950s to today's sophisticated biomethane production facilities, the journey of UK biogas development reflects broader changes in our approach to waste management, renewable energy, and agricultural sustainability.

Historical Development (2000-2015)

The modern era of UK biogas began with the government's “Waste Not Want Not” report in 2000, which first recognized AD's dual role in waste management and renewable energy production.

During the period up to 2010, the industry consisted primarily of small-scale agricultural digesters and municipal waste treatment facilities. Digesters were installed as a sludge treatment process to reduce sludge disposal costs. In those early years electricity generation for use on-site was seen as an incidental benefit.

The first plants relied on electricity generation and low tariffs paid by the Uk energy market. Use of the heat energy (known as CHP) was limited to on-farm use or space heating at sewage works.

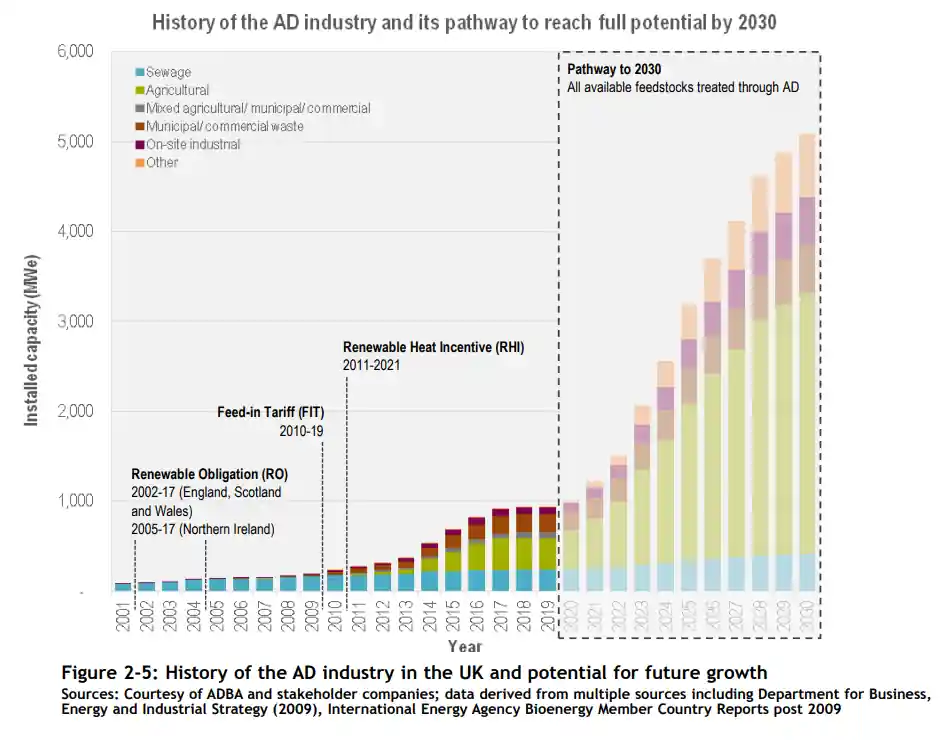

The introduction of Renewable Obligation Certificates (ROCs) and Feed-in-Tariffs (FiT) under the Labour government (1997 to 2010) created the first significant growth phase.

These financial incentives helped overcome the initial barriers of high capital costs and long payback periods that had previously limited industry expansion.

The UK Biogas Industry Stagnation Years (2015-2021)

The removal of government subsidies and uncertainty surrounding Brexit led to a period of industry stagnation. Despite this, the sector continued to innovate, focusing on efficiency improvements and cost reduction.

This challenging period ultimately will most likely be see as laying the groundwork for the industry's later renaissance if the Labour government elected in 2024 backs the UK biogas industry with new incentives.

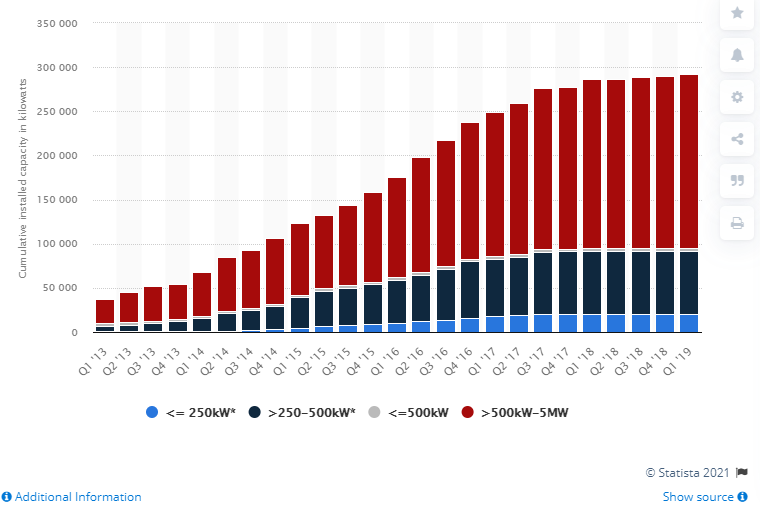

The stagnation years are shown graphically in the Statista data plot below, based on UK government figures.

The cumulative installed capacity of anaerobic digestion in the United Kingdom (UK) from the 1st quarter 2013 to the 1st quarter 2019, by tariff type (in kilowatts)

The Anaerobic Digestion Process Renaissance (2022-2025)

The biogas renaissance began in earnest in 2022, driven by several factors:

- Technological Breakthroughs

- Advanced biomethane upgrading systems achieving 99% methane purity

- Implementation of computer-controlled continuously monitored digestion processes

- Development of modular, scalable AD systems

- Regulatory Changes

- Introduction of UK EA defined Nitrogen Sensitive Zones for water quality protection

- Mandatory food waste collection across all UK regions starting in 2025

- The Non-Fossil Fuel Obligation and more recently the Green Gas support scheme

- Market Evolution

- Integration with smart grid systems

- Increasing pace of development of biomethane as a transport fuel

- Premium pricing for high-quality digestate fertilizers

- Development of carbon capture by utilisation of CO2 produced as a process byproduct

The Milestone Formation of the UK Biogas Industry Trade Body “ADBA”

The Anaerobic Digestion and Bioresources Association (ADBA), formerly the Anaerobic Digestion and Biogas Association, is the primary trade association for anaerobic digestion and related industries in the United Kingdom.

ADBA was founded in September 2009 by Lord Redesdale and ten founding member companies to represent businesses involved in the anaerobic digestion and biogas industries. Its goal is to assist in the removal of barriers to anaerobic digestion and to assist its members in growing their businesses.

In the foreword to “Biomethane: The Pathway to 2030,” an ADBA report released in early March 2021, Charlotte Morton, Chief Executive of the United Kingdom's Anaerobic Digestion and Bioresources Association (ADBA), wrote the following:

“time and time again, prominent organizations with the ear of our government have highlighted biomethane’s vital role in the [current] decade of decarbonization. While the UK's net-zero goal is suitably ambitious, it cannot be achieved without immediate and significant investment in sustainable technologies, such as anaerobic digestion (AD).”

Current State and Future Outlook

Today's AD industry bears little resemblance to its early predecessors. Modern facilities utilize advanced monitoring systems, predictive maintenance, and automated operations.

Looking ahead to 2030, the industry's potential is remarkable. Projections show the sector could:

- Create an impressive 60,000 jobs (split equally between direct and indirect employment)

- Achieve carbon savings equivalent to removing one-third of all UK cars from the road

- Generate enough biomethane to heat 6.8 million homes – roughly equivalent to heating every household in Scotland and Wales combined

Anaerobic digestion isn't just about waste management – it's about creating a sustainable future that turns problems into opportunities, waste into wealth, and challenges into solutions.

The integration of AD into broader circular economy initiatives by responsible companies setting out to implement their sustainability targets. Sustainability planning has created new value streams and business models. This will continue and is likely to accelerate.

The new labour government appears to be considering implementing new incentive schemes for 2025 needed to comply with the UK's decarbonisation targets.

The UK will be out of step with the EU, and wil many nations globally (including the US) if it does not follow the EU example and provide similar incentives to those available in EU member nations.

UK Anaerobic Digestion Industry: 2025 State of the Sector Report

A Green Revolution in Action

The UK's anaerobic digestion (AD) industry has emerged as a powerhouse in the nation's fight against climate change, with 756 operational plants now forming the backbone of our organic waste management infrastructure.

These facilities are quietly performing what amounts to industrial-scale alchemy – transforming millions of tonnes of organic waste into valuable green energy and nutrient-rich fertilizer.

Current Impact

In a remarkable feat of circular economy principles at work, the sector currently processes 36 million tonnes of organic waste annually – material that would otherwise decompose in landfills, releasing potent greenhouse gases into the atmosphere. To put this in perspective, that's equivalent to the weight of about 3,600 Eiffel Towers in organic waste being recycled each year.

The industry's contribution to the UK's energy matrix is equally impressive, generating 21TWh of biogas annually. This green gas serves two crucial purposes: powering combined heat and power (CHP) units for local energy generation, or being upgraded to biomethane for injection into the national gas grid.

Economic and Environmental Benefits

The sector has become a significant employer, currently supporting 4,800 jobs across the country.

Perhaps most importantly, it's making a measurable impact on the UK's carbon footprint, delivering a 1% reduction in national greenhouse gas emissions – a significant achievement for a single industry.

Growth Trajectory

Despite challenges, the industry demonstrated resilience with 5% growth over the past year. This growth tells an interesting story of sector maturation:

- while some smaller, older plants have closed,

- they've been more than offset by the commissioning of larger, more efficient facilities focused on gas grid injection.

Frequently Asked Questions

Q: What is the current capacity of UK biogas production?

A: As of 2025, the UK has over 1,000 operational AD plants with a combined capacity of 2.5 GW equivalent, (including sewage sludge digesters at Wastewater Treatment Facilities).

Q: How does modern AD technology differ from earlier systems?

A: Modern systems feature AI-controlled processes, advanced monitoring, and integrated upgrading systems for biomethane production. They achieve conversion efficiencies up to 40% higher than 2020 systems.

Q: What are the main feedstocks used in UK AD plants?

A: Current feedstocks include food waste (40%), agricultural waste (30%), sewage sludge (20%), and energy crops (10%).

Q: How has digestate quality improved?

A: Advanced processing techniques now produce standardized, pathogen-free digestate with guaranteed nutrient content, making it a premium alternative to chemical fertilizers.

UK Biogas History – Conclusion

The UK biogas industry's journey from 2000 to 2025 demonstrates the potential for technological innovation and policy support to transform an entire sector.

What began as a simple waste treatment process has evolved into a sophisticated industry that now plays a crucial role in renewable energy production, waste management, and sustainable agriculture.

As we look toward 2030 and beyond, the continued evolution of AD technology promises to further enhance its contribution to the UK's sustainable future.

UK AD History Milestone – The Ludlow Digester – The 1st Dedicated Commercial-Scale Food Waste Digester in the UK

The Ludlow Digester, the first purpose-built dedicated food waste “AD Waste Technologies Programme” DEFRA funded “Demonstrator Plant”, kick-started the history of food waste anaerobic digestion plants in the United Kingdom.

In the United Kingdom, the history of dedicated food waste anaerobic digestion plants began in 2004, with the opening of this innovative government-funded plant.

Greenfinch Biogas was chosen to design and install the plant as well as operate it during the trial period.

Nobody in the UK biogas industry was sure at the time that dedicated AD plants accepting only food waste could be made to run reliably for long periods of time. It was common, for the few existing operators running plants at the time, to see their biogas digesters turn sour and require emptying every few years.

Subsequently, groundbreaking basic research conducted at Southampton University has shown that long-term stable biogas plants treating solely food waste are possible. However, some essential trace elements which may not be present in food need to be added by dosing food waste digesters with the correct trace elements.

What Needs to be Done to Develop UK Biogas and Anaerobic Digestion?

A recent ADBA report identifies key policy asks that will enable flourishing results in order for the industry to reach its full potential. They are as follows:

- Immediate support for biomethane production beyond 2025

- Extending the renewable transportation fuel obligation beyond 2032

- Innovation funding

- formation of resource hierarchies for all organic wastes, with anaerobic digestion as the best recycling technology

- government has an obligation to develop a renewable biofertilizer

- assistance with local circular economy projects centred on food waste recycling via anaerobic digestion into heat and power generation

“Now is the time to ensure policymakers understand the potential for energy from waste technologies to contribute to net-zero and the creation of a more circular economy,”

said Chris Winward, chief commercial offer at Privilege Finance and SNG.

A significant increase in demand for biomethane from the biogas sector, combined with favourable energy and environmental policies, is another driving factor in this market.

The Best Years for Growth in UK Biogas Output

According to a 2017 survey by the Anaerobic Digestion and Bioresources Association (ADBA), UK biogas facilities even at that time produced enough biogas to power over one million homes.

Plant numbers increased about 500% in the five years between 2013 and 2018, indicating that the technology exploded in popularity across the UK over those years. This increase was partly due to the RHI and FiT schemes implemented by the UK government, which provided agriculture firms with a steady income.

This guaranteed revenue from government support was frequently the final confidence boost for investors and allowed biogas projects to be funded. In future, confidence in the long-term financial viability of AD plants will come from:

- increased efficiency and hence better profitability

- higher prices paid in the sale of biomethane due to supply and demand effects in a market where there will never be enough biomethane to meet the demand.

Archive Content:

Investment Outlook for the UK’s Biogas Plants

In the decade up to 2010, renewable energy in the UK would have conjured up images of two things:

- wind turbines and

- solar panels,

since these were the main focus of media attention, government subsidies and investor inflows.

Now in 2021, just over 10 years later anaerobic digestion is no longer a foreign territory to financiers. The investment background for this sector has thankfully come on in leaps and bounds.

The UK biogas industry is now providing excellent opportunities for investors to derive a stable income stream from a diversified array of renewable infrastructure assets.

If an investor needs to find out more about a biogas investment. There are highly experienced UK biogas companies that now offer operational and advisory services within the construction, waste, and renewable energy industries.

Malaby Biogas is an example of an organisation with extensive expertise operating UK AD plants. It provides a wide range of services, including financial guidance for AD plant projects. Their business was designed to give comprehensive solutions using anaerobic digestion (AD) technology and is situated in Warminster, Wiltshire.

Malaby Martin Ltd, is a sister company to the UK biogas business. It has been a property development company specialising in rural redevelopment for over 12 years. They have a good depth and breadth of technical and practical knowledge as a result of this. They claim to be increasingly providing expert advisory services for renewable energy projects both in the UK and abroad.

Anaerobic digestion is also a well-established method in the UK for treating food waste and other biowastes

Energy production, nutrient control, waste stabilisation, and pathogen reduction are all benefits of the procedure. It also helps to reduce greenhouse gas emissions in all of these ways, both directly and indirectly.

It's the only technology on the market right now that can produce second-generation biofuels according to European standards.

And yet, in the period 2017 to 2021, the number of plants has grown only slowly and near-stagnation of the industry has occurred.

But that will surely change by 2022 with:

- rising prices for biomethane being paid for use as a fuel for heavy goods transport

- renewed UK government support through long-term renewals of the RHI and Green Gas Support Scheme

- better information (hopefully) provided by the government to the agricultural sector on future support for farming

- innovations in AD plant design leading to increased profitability and reduced payback periods for new AD plants, and

UK biogas can make a real difference in the fight against runaway global warming.

[This page was originally published in 2015, completely updated in August 2021. Rewritten in January 2025.]

I have checked your site, which I like in general. But, i read this article which says that the UK government has set-up subsidies to encourage the bio-energy industry sector.

How true is that now?

We have seen our incentive revenue reduced, by the government since the date given for this article.

Where are these incentives now in 2018?

I discovered podcasting recently, and you should try it. Make biogas podcasts of articles like this. Podcast production doesn’t have to be anything puzzling.